History

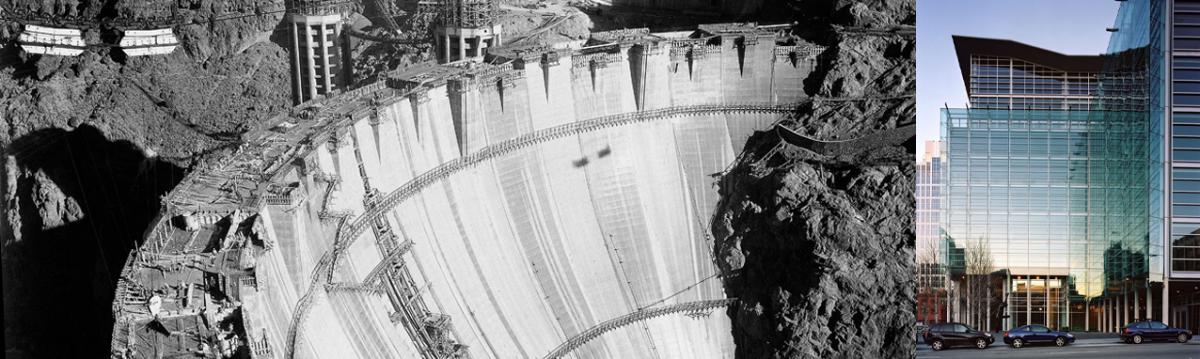

The history of Fremont Group traces its roots to the early investments of Bechtel Group, a leading global engineering and construction company founded in 1898.

In 1980, Bechtel Investments, Inc. (BII) was formed as a subsidiary of Bechtel Group to manage its then existing portfolio consisting primarily of real estate and energy-related assets and to pursue new and innovative investment opportunities. Bechtel Group selected an outstanding management team of seasoned executives from the company to lead the new investment enterprise. Alan M. Dachs, Fremont Group’s Chair of the Board, joined the management team in 1982. Mr. Dachs and Steven V. White, the first President of BII, embarked on the hiring of experienced investment professionals to form and develop key areas of investments, including real estate, direct investments, energy, venture capital, and securities management.

In 1986, BII became an independent company and in 1989, Mr. Dachs was elected President. In 1993, BII changed its name to Fremont Investors, Inc. (FII). In the same year, Fremont Group, L.L.C. was formed to manage the assets of FII. Today, all Fremont entities are collectively referred to as Fremont Group.

In 1995, Alan M. Dachs was elected Chief Executive Officer and President of Fremont Group. He currently is the Chair of the Fremont Group Board. David R. Covin was elected President of Fremont Group in 2021. In December 2023, the Fremont Group Board elected Eric Bechtel Dachs as Chief Executive Officer effective January 1, 2024.

The following timeline depicts the history and evolution of Fremont Group in its journey towards becoming a premier private family investment company. The timeline highlights selected investments and significant events in Fremont Group’s history.

| 1960 | |

1970 | |

1980 | |

1990 | |

2000 | |

2010 | |

2020 | |

1967

The development of 50 Beale Street in San Francisco, California, a 23-story high-rise office building, was completed and would serve as Bechtel's headquarters.

1969

In October, downtown San Francisco 0.7-acre parcel (Block 3719) was purchased, and then developed in the late 1990s into a 25-story high-rise, multi-tenant building. In 2000, 199 Fremont Street became Fremont Group's headquarters.

1973

In October, 425 Market Street, San Francisco, California, a 938,000 square foot, multi-tenant office tower, opened, developed in partnership with The Shorenstein Company, IBM and Metropolitan Life.

March 1977

Peabody Holding Company, Inc. (1977-1990) – Bechtel acquired an interest in Peabody Holding Company, Inc., the leading coal mining company in the United States, along with partners Newmont Mining Corporation, Boeing and The Williams Companies. Bechtel sold its interest in 1990 for an excellent return.

1980

In April, Bechtel acquired an interest in Dual Drilling Company (1980-1990), an oil and gas exploration company, with headquarters in Wichita Falls, Texas.

1981

In July, Dillon, Read & Company (1981-1986), one of the leading banking firms in the United States, was acquired. The investment was sold in 1986.

1986

In March, Bechtel Park Tower, a real estate development partnership was formed between Bechtel Investments, Inc. and Park Tower Realty, a New York real estate development firm. Notable projects included the Foley Square Federal Courthouse in New York.

Bechtel Investments, Inc. formed Trinity Ventures (1986-Present), a venture capital firm in Silicon Valley. Trinity Ventures has invested in such leading companies as Starbucks, Extreme Networks, Aruba Networks, Blue Nile, SciQuest, and Zulily.

1989

Alan M. Dachs was elected president of Bechtel Investments, Inc.

1990

Bechtel Investments, Inc. expanded by beginning to accept third party capital and creating funds for investing in direct investments, real estate, venture capital and communications.

1991

Fremont Partners was formed to make larger private equity investments with a controlling position, investing in companies with strong management teams that would make excellent partners.

In August, Fremont Partners acquired Crown Pacific (1991-2003), a leading forest products company in the Northwest U.S.

1993

Bechtel Investments, Inc. changed its name to Fremont Investors, Inc.

In October, Fremont Partners acquired Coldwell Banker (1993-1996), a leading residential real estate brokerage company. Previously owned by Sears, Fremont Group saw a company with a strong franchise, an excellent market share and a talented management team. The company was sold in 1996 for a significant profit.

1995

Alan M. Dachs was elected President and CEO of Fremont Group, Inc. in June 1995.

1997

Fremont Group formed Fremont Realty Capital (FRC) to originate, structure, close, and manage equity investments in public and private real estate projects, programmatic real estate investment vehicles, and real estate operating companies.

Fremont Realty Capital launched its first investment fund, Fremont Strategic Property Partners, which included third party capital.

1998

In May, Fremont Realty Capital acquired Shurgard Storage Centers, Inc., a leader in self-storage facilities.

2003

Fremont Public Opportunities was formed to invest in publicly traded equities.

2004

Fremont Realty Capital launched its second investment fund, Fremont Strategic Property Partners II.

2005

The BF Global Fund was created.

2007

FPR Partners was formed to enable a broader group of institutional clients to invest in the publicly traded equities strategy begun by Fremont Public Opportunities.

2012

May — Fremont Private Holdings was established to acquire controlling interests in a select portfolio of privately-held, middle-market operating companies.

July — Fremont Realty Capital purchased a majority interest in MyPlace Holdings, the largest owner and operator of self-storage facilities in Germany, Austria and Switzerland.

December — Fremont Private Holdings acquired a controlling interest in the In-Shape Health Clubs, a leading operator of health clubs in California.

2014

February — Fremont Real Estate Funds was created to invest in real estate operating companies as Fremont Realty Capital continued harvesting its older investments.

Fremont Real Estate Funds entered into a joint venture with Metro Self Storage Development LLC, a leading, vertically-integrated, self-storage owner/operator in the U.S. The Fremont-Metro joint venture will develop and redevelop self-storage properties in specified U.S. metro areas for a long term hold.

April — Fremont Private Holdings acquired an interest in Mission Products Holdings, Inc., a branded consumer products company focused on disruptive sports technologies that elevate performance.

December — Fremont Real Estate Fund closed on the acquisition of 100% of the Blue Self-Storage S.L.U. (Bluespace), the largest owner-operator of self-storage facilities in Spain.

2015

October — Fremont Private Holdings acquired an interest in Process Displays (PD), a leading designer and manufacturer of customized print and store fixture solutions. PD serves brands seeking to enhance their presence in the retail store environment as well as retailers looking to increase sales performance.

2016

March — Fremont Private Holdings acquired a controlling interest in Morrie's Automotive Group, owner and operator of eleven (11) automotive dealership locations in the Minneapolis, MN area as well as the real estate associated with ten (10) of the locations. The company's ten (10) brands include Aston Martin, Bentley, Cadillac, Ford, Hyundai, Lincoln, Maserati, Mazda, Nissan, and Subaru.

December — Fremont Private Holdings acquired a significant minority interest in the Flynn Group of Companies, a family and management-owned provider of building envelope solutions headquartered in Toronto, Ontario.

2021

Alan M. Dachs was elected Chair of the Board of Fremont Group in March 2021.

David R. Covin was elected President of Fremont Group in March 2021.

2024

Eric Bechtel Dachs was elected Chief Executive officer effective January 1, 2024.